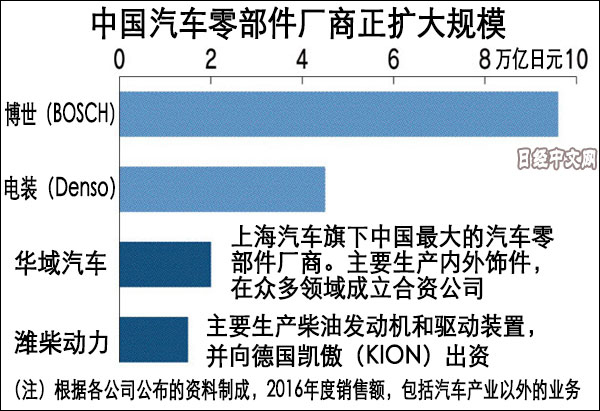

The ever-growing Chinese auto parts manufacturers are acquiring companies and businesses in Japan, the US, and Europe one after another, which has caused concern in Japan. The Nikkei Chinese website issued a document on the 21st, saying that China's large-scale parts and components companies have accumulated technology through cooperation with Japan, the United States, and European companies, and have turned from exporting to shipping to overseas markets. During this period, the acquisition strategy was advanced, and the relationship with Japanese manufacturers gradually shifted to the direction of competition. Image from: Nikkei Chinese Network Chinese companies strengthen acquisitions According to the report, at the end of March, Japan’s largest car headlight manufacturer, Otaru Manufacturing Co., plans to transfer its holdings to Huayu Automotive, a parts and components company owned by Shanghai Automotive, at a price of approximately 24 billion yen (1.4 billion yuan). Shanghai Xiaolan 45% shares of headlights. Shanghai Xiaoyi headlights is a cooperative company established by Kosaka Production and Huayu Automobile. The reason for the transfer of shares is that Huayu Automotive requested Xiaoyan to enter the North American and European markets. The two sides have huge differences in their operating policies. If the joint venture company, Shanghai Xiaoxuan, enters Europe and the United States, it will compete with the Otaru Manufacturing Co., which already has overseas operations. Although Xiao Biao's headlights are the largest production base of Xiao Biao's production in China, Xiao Biao eventually decided to abandon its partnership with Wah Yuen. Huayu, on the other hand, intends to supply components to its parent company Shanghai Automotive, which is a joint venture with American automakers such as General Motors (GM). The report also stated that many auto parts manufacturers in China have expanded their domestic businesses with the help of talents and technologies obtained from joint ventures, and the scale of numerous small and medium-sized manufacturers has also expanded. Statistics show that the annual sales of auto parts amount to 50 trillion yen. As a certain technology and sales channels have been secured, China's auto parts companies have turned to independent domestic and foreign markets for growth. Jiangsu Jixing Group, which manufactures automotive interior components, has also set up a base in Japan. Japan's parts and components manufacturers are worried that "(Ji Hing) has a strong development capability, the competitiveness continues to increase." In addition, mergers and acquisitions of independent parts and components companies are also active. China Junsheng Electronics acquired Key Safety Systems (KSS), which manufactures automotive safety components in 2016. It is expected that the Canadian business will be acquired through KSS in 2018. Weichai Power, which mainly produces diesel engines, announced in March 2017 that it will acquire a 51% stake in natural gas engine manufacturer US Power Solutions International Inc. Natural gas engines can be mounted on buses and other vehicles. The Zhengzhou Coal Mine Machinery (ZMJ), which manufactures parts such as motors, has acquired a subsidiary that produces starter motors from Bosch, Germany. Chinese companies become bigger and stronger The Chinese government also supports the expansion of parts and components companies. The "Medium-term and long-term development plan for the automotive industry" announced in April 2017 proposes that by 2020 a number of auto parts companies with annual sales of more than 100 billion yuan will be nurtured, and by 2025 a number of sales will be cultivated to enter the top 10 global companies. Joyson Electronics' sales in fiscal 2016 was 300 billion yen, and Weichai Power was 1.5 trillion yen. Although it is relatively small compared to Bosch (about 9.6 trillion yen) and Denso (about 4.5 trillion yen), it has established relationships with Japanese, American, and European vehicle companies in China and overseas. Great business development space. According to reports, China's parts and components companies not only become competitors to Japan's parts companies in the world market, but also may take away local businesses in Japan. According to the Japan Automobile Parts Industry Association, the sales of Japanese parts and components companies in China in 2016 were 3.6 trillion yen, accounting for more than 20% of the total global sales. However, the average sales of Japan's spare parts companies entering China is 13.2 billion yen. Compared with local Chinese companies, they have no advantage in terms of scale. To this end, Zhang Yi, a senior consultant of the Nomura Research Institute of Japan, pointed out that the win-win relationship at the beginning of the joint venture will become weak, and it is necessary to adjust the joint venture plan and product structure. Whether Japanese auto parts companies can gain market growth is currently at a crossroads. Customized Rubber Seals,Rubber Gasket,Rubber Gasket Sheet,Rubber Gasket Seal Ningbo Robon Sealing CO.,LTD , https://www.rboorb.com

January 31, 2024